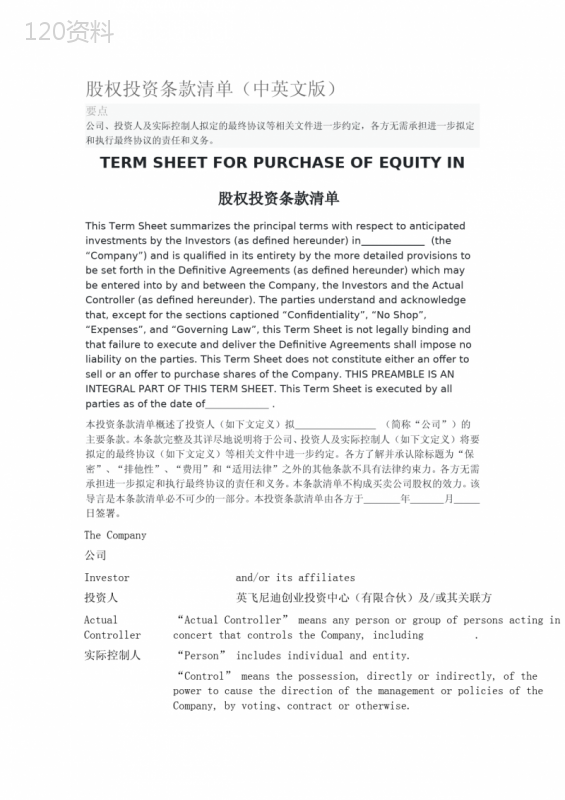

股权投资条款清单,股权投资尽职调查清单

本作品内容为股权投资条款清单,格式为 doc ,大小 89128 KB ,页数为 13页

('股权投资条款清单(中英文版)要点公司、投资人及实际控制人拟定的最终协议等相关文件进一步约定,各方无需承担进一步拟定和执行最终协议的责任和义务。TERMSHEETFORPURCHASEOFEQUITYIN股权投资条款清单ThisTermSheetsummarizestheprincipaltermswithrespecttoanticipatedinvestmentsbytheInvestors(asdefinedhereunder)in(the“Company”)andisqualifiedinitsentiretybythemoredetailedprovisionstobesetforthintheDefinitiveAgreements(asdefinedhereunder)whichmaybeenteredintobyandbetweentheCompany,theInvestorsandtheActualController(asdefinedhereunder).Thepartiesunderstandandacknowledgethat,exceptforthesectionscaptioned“Confidentiality”,“NoShop”,“Expenses”,and“GoverningLaw”,thisTermSheetisnotlegallybindingandthatfailuretoexecuteanddelivertheDefinitiveAgreementsshallimposenoliabilityontheparties.ThisTermSheetdoesnotconstituteeitheranoffertoselloranoffertopurchasesharesoftheCompany.THISPREAMBLEISANINTEGRALPARTOFTHISTERMSHEET.ThisTermSheetisexecutedbyallpartiesasofthedateof.本投资条款清单概述了投资人(如下文定义)拟(简称“公司”)的主要条款。本条款完整及其详尽地说明将于公司、投资人及实际控制人(如下文定义)将要拟定的最终协议(如下文定义)等相关文件中进一步约定。各方了解并承认除标题为“保密”、“排他性”、“费用”和“适用法律”之外的其他条款不具有法律约束力。各方无需承担进一步拟定和执行最终协议的责任和义务。本条款清单不构成买卖公司股权的效力。该导言是本条款清单必不可少的一部分。本投资条款清单由各方于年月日签署。TheCompany公司Investor投资人and/oritsaffiliates英飞尼迪创业投资中心(有限合伙)及/或其关联方ActualController实际控制人“ActualController”meansanypersonorgroupofpersonsactinginconcertthatcontrolstheCompany,including.“Person”includesindividualandentity.“Control”meansthepossession,directlyorindirectly,ofthepowertocausethedirectionofthemanagementorpoliciesoftheCompany,byvoting、contractorotherwise.“实际控制人”指控制公司的任何人或一致行动人,包括。“人”包括自然人和实体。“控制”指通过行使投票权,合同或以其它方式直接或间接的拥有指示或决定公司经营方向或公司的政策。ExistingShareholders现有股东“ExistingShareholders”meansanyindividualsandentitieswhoholdsharesoftheCompanyatthesigningdayofthistermsheet,including:ShareholdersRegistercapitalProportions“现有股东”指在本投资条款清单签署之日持有公司股权的自然人及企业,包括股东出资额(人民币元)持股比例Pre-moneyEvaluation融资前估值RMB,basedontimesaftertaxnetincomeoftheCompanyforthefiscalyear.人民币元,即公司年度税后净利润的倍InvestmentAmounts投资金额TheInvestorsintendtoinvestRMBintheCompanytopurchasenewlyissuedsharesoftheCompanyandwillhold%oftheCompany’sregisteredcapitalaftercompletionoftheClosing.投资人有意向公司投资人民币元,其将持有交割完成后公司全部注册资本总额之%。Pre-moneyandPost-moneyCapitalTables公司融资前后股权变化Pre-money投资前Post-money投资后%%%%%%%%Total总计%%TargetClosingTheClosingDateisexpectedtotakeplacewithinbusinessDate交割日daysfromtheeffectivedateoftheDefinitiveAgreements.TheInvestorswillwiretransferalloftheirinvestmentsumtothenewlyopenedcapital-verificationaccountoftheCompany.交割预计将于最终协议生效之日起个工作日内进行,届时投资人向公司新开立的验资账户支付全部投资款项。QualifiedIPO合格的首次公开发行“QualifiedIPO”meanstheclosingofafirmcommitmentunderwrittenpublicofferingofcommonsharesoftheCompanyatShanghai/ShenzhenStockExchange,theMainBoardoftheHongKongStockExchange,NYSE,NASDAQorotherinternationallyrecognizedstockexchanges,withtheCompany’smarketcapitalizationatleastRMBandfundingsizenolessthanRMB.TheActualControllerandtheCompanyundertaketousetheirbestendeavorstoachieveaQualifiedIPOinanycaseby,andtomaketheCompany’sshareshavereasonableliquidityaftertheQualifiedIPO.“合格的首次公开发行”指在上海/深圳证券交易所、香港证券交易所主板、NYSE、NASDAQ或其它得到国际认可的证券交易所进行的一次承销的公开招股,且公司的市场价值至少达到亿人民币,并且融资规模不少于亿人民币。实际控制人和公司承诺尽最大努力在年月日前实现首次公开发行,并且在公开发行后保持公司股票足够的流动性。NetProfitGuarantee业绩承诺TheCompanyundertakesandguaranteesthatitsaftertaxnetprofitoffinancialyearisnotlessthanRMB,anditsaftertaxnetprofitoffinancialyearisnotlessthanRMB.TheaftertaxnetprofitshouldbeauditedbyanauditorpermittedbytheInvestorsinwriting,andshouldnotincludeextraordinarygainsorlosses.公司承诺其年税后净利润不低于人民币万元,其年税后净利润不低于人民币万元。(分别称为“”)税后净利润须经投资人书面认可的会计师事务所进行审计,且应扣除非经常性损益。ValuationAdjustment估值调整IftheCompanyfailstoachieveitsnetprofitguaranteeintheyearof,eachoftheInvestorsshallhavetherighttoadjustitsshareproportionbyrequestingtheActualControllertotransfersharesvoluntarilybasedonthefollowingformula:TheInvestor’sadjustedshareproportion=(NetProfitGuarantee/actualafter-taxnetprofit)theInvestor’spre-adjustedshareproportionTheafter-taxnetprofitintheyearofshouldbeauditedbyanauditorpermittedbytheInvestorsinwriting,andshouldnotincludeextraordinarygainsorlosses.If,however,theActualControllerhasn’tconductedsuchshareadjustmentinpreviousyear,ifany,thenitshouldcompensateshareadjustmentinthatyearinprior,thenbasedonsuchadjustment,shoulditcontinuetocompensatetheInvestorswithshareadjustmentinthefollowingyear.如果年度公司未实现当年业绩承诺,则每一投资人的持股比例将按照如下公式进行调整,并通过实际控制人向每一投资人无偿转让股权的方式进行操作:调整后的投资人持股比例=(年度业绩承诺/年度实际税后净利润)调整前投资人的持股比例年度实际税后净利润为该年度公司经投资人书面认可的会计事务所审计且已扣除非经常性损益的税后净利润。若实际控制人对每一投资人进行该年度股权补偿时其尚未实施对投资人的上一年度股权补偿(若有),则须按照上述公式计算先行计算上一年度的股权补偿数额,再在其基础上计算该年度的股权补偿数额。PreferredParticipationRight优先参与权Tothefullestextentofapplicablelaws,theInvestorswillhavetherightoffirstrefusaltosubscribeforfutureissuanceofthesharesbytheCompanypriortoaQualifiedIPO,proratainproportiontotheirrespectiveshareholdingintheCompany,excepttheissuanceregardingESOP.Fortheavoidanceofdoubt,suchrightoffirstrefusalwillterminateupon,andshallnotinclude,theCompany’sQualifiedIPO.在适用法律允许的范围内,每一投资人有权按照其持有的公司股权的比例以第一顺序认购公司未来新发行的股权,但公司为实施员工股权激励计划而新增发行股权的除外。本权利自公司发生合格的首次公开发行时终止。PreemptiveRight&Co-saleRight优先购买权和共同出售权UntiloccurrenceofQualifiedIPO,ifanyExistingShareholderoftheCompanyotherthanInvestorsintendstotransferanypartorallofitsequityintheCompanytoanythirdparty,eachInvestorshall(i)haveapreemptiverightand(ii)beentitledtoco-saleitsshareholdingoftheCompanyonapro-ratabasis.在合格的首次公开发行前,如果投资人以外的任何现有股东拟出售其持有的公司全部或部分股权,每一位投资人均(i)有优先购买权和(ii)有权按届时其持股比例共同出售其持有的公司股权。PreferredDividendRight优先分红权TheCompanymaydeterminepaymentofdividendsfromtimetotimeinaccordancetotheArticlesofAssociation,eachofInvestorshasapreferreddividendrighttoreceivedividendpriortoanyothershareholdersonapro-ratabasis.公司根据公司章程有权决定是否分红,每一投资者均有权按照其持股比例优先于其他股东取得相应的分红。PreferredDispositionRight处置权EachoftheInvestorshasapreferredrighttotransfer,sellordisposeofallorpartsofitsequityintheCompanyatitssolediscretionatanytime.每一投资人均有权在任何时间依其独立判断优先地向第三方转让、出售或处置其持有的全部或部分公司股权。InformationRights信息披露UntiloccurrenceofQualifiedIPO,theCompanyshalldeliver,andtheActualControllersshallcausetheCompanytodeliver,toeachoftheInvestors(i)annualauditedfinancialstatementsbynolaterthan90daysfollowingtheendofitsfiscalyear,auditedbyanaccountingfirmreasonablyacceptabletotheInvestors,(ii)quarterlyunauditedfinancialstatements(includingbalancesheet,incomestatementandstatementofcashflow)within45daysfollowingtheendofeachquarter;(iii)anannualoperatingplanandbudgetatleast30dayspriortothefirstdayoftheyearcoveredbysuchplanandbudget,and(iv)anyotherreportorinformationreasonablyrequired.Inaddition,theInvestorsshallalsobeentitledtocustomaryinspectionandvisitationrights.AllthefinancialstatementsmustbepreparedinaccordancetoChineseGAAP.合格的首次公开发行之前,公司应向(或实际控制人应促使公司)投资人提供下列信息:1、在会计年度结束之后的90天内提供年度财务审计报告,该中介机构应经投资人认可,并应考虑节约审计成本;2、每季度结束后45天内提供季度资产负债表,利润表,现金流量表;3、在下一财务年度开始前的30天内提供下年度预算报告和业务计划;4、其它合理所需信息和报告。此外,投资人也有资格进行例行检查及行使探访权。所有的财务报告必须根据中国的通用会计准则准备。Lock-upPeriod锁定期WithinmonthsfromoccurrenceofQualifiedIPOatdomesticstockexchangeorwithinmonthsfromoccurrenceofQualifiedIPOatNASDAQoranyotherinternationallyrecognizedstockexchanges,orwithinanyotherLock-upPeriodformulatedbyrelevantstockexchangeandagreedandundertookbythepeoplehereinafter(togetherthe“Lock-upPeriod”),noneofActualControllersandfamilymembersthereofmaysellanypartofitsequityintheCompany.AftertheendoftheLock-upPeriod,aslongasanyoftheInvestorsremainholdingnolessthan%equityintheCompany,neitherActualControllersnorthefamilymemberthereofmaysellmorethan%ofhis/herentireequityintheCompanywithinanycalendaryearandintheaggregate,morethan%ofhis/herentireequityintheCompany.TheEquityinterestholdbytheInvestorswillnotsubjecttolock-upperiodclauseinanyform,eachoftheInvestorshasarighttosellalloranyofitsshareholdingtoanythirdpartyatitssolediscretion.自在国内证券市场发生合格的首次公开发行起个月内或在纳斯达克或上文中提及的其他证券交易所发生合格的首次公开发行起个月内(简称“锁定期”),或在相关证券市场规定并由下文中提及的人员同意且承诺的锁定期内,实际控制人、核心管理层及他们各自的家庭成员均不得出售公司的任何股权。在锁定期结束后,只要任何一位机构投资人仍然持有公司%以上的股权,实际控制人、管理层及他们各自的家庭成员在任何一个年度不得出售超过其持有的公司股权的%,并且累计不得超过其持有的公司股权的%。投资人所持有的股权不受任何形式的锁定期限制,任一投资人均有权依其独立判断向第三方转让其持有的全部或部分公司股权。Anti-dilutionRight反稀释权ProvidedthattheCompanyissuesanyEquitySecuritiesatapricelowerthanthepriceInvestorspaid,thepriceInvestorspaidshouldbeadjustedsothattheafter-adjustedpriceofsharesholdbytheInvestorsequalstothatoftheEquitySecuritiesnewlyissuedtothethirdparty.SuchrightshouldnotbeexercisedincircumstancesofissuancesofsharesregardingESOP.如果公司发行的任何权益证券的价格低于投资人支付的购买价格,每一位投资人均有权在全面稀释的基础上对持股价格进行调整,以使得调整后的价格等于向第三方发行的新的权益证券的价格。但是根据员工股权激励计划发行的股权不在此限。FullyDiluted“FullyDilutedBasis”means,indeterminingthenumberofsharesBasis全面稀释原则oftheCompany’scapitalstockdeemedtobeoutstandingasofanydateofdetermination,thatsuchdeterminationassumestheconversion,exercise,issuanceorexchange,asthecasemaybe,ofallEquitySecuritiesthatarethenoutstandingandareconvertible,exercisableorexchangeablefortheCompany’scapitalstock.“EquitySecurities”meanalloftheCompany’sissuedandoutstandingsecuritiesandallrightstoacquiresuchsecurities,includingbutnotlimitedtoalloutstandingwarrants,options(whetherallocatedorunallocated,promisedorun-promised,vestedorunvested),oranyotherrightgrantedtoanythirdpartytoreceivesecuritiesoftheCompanyoranti-dilutionrightsofexistingshareholders.“充分稀释基础”是指:假设公司已发行的所有可转换、可行权、可交易的权益证券均被全部转换、行权或交易,并在此基础上计算出公司已发行的权益证券的数量。“权益证券”是指,所有已发行并流通在外的股权以及所有获取此股权的权利,包括但不限于发行在外的期证、选择权(无论是已分配还是未分配,承诺还是未承诺的,兑现还是未兑现),或授予第三方取得此类证券,或现有股东享有的反稀释权。RedemptionRight赎回权Ifanyofthefollowingeventsoccurs,eachoftheInvestorsshallhavearighttorequireActualControllerstorepurchaseallorpartofitsequityintheCompanyonapro-ratabasisataredemptionprice:i.theCompanydoesnotachievetheNetProfitGuaranteeofor;ii.theCompanydoesnottakeplaceaQualifiedIPOby;iii.ActualControllershasmaterialcreditproblems,particularly,there’reoff-balance-sheetsalesrevenueandexpenses.TheBuybackPriceshallequaltotheInvestmentAmountspreviouslypaidbyeachoftheInvestorsplusfinancingcostbasedon%IRR(inclusiveofcashdividendspaidbytheCompanytotheInvestor).i.e.IfanInvestorrequiresActualControllerstobuybackitsequityintheCompanyafterNyearsfollowingtheclosing,theBuybackPriceshallequaltoInvestmentAmountmultiplied(1+12%)n..BesidesaforementionedBuybackright,eachoftheInvestorsshallalsohavearighttoselltheirequitytoanyinterestedbuyersexceptcompetitorsoftheCompany,includinganystrategicinvestors.Ifthereismorethanonesuchinterestedbuyer,theInvestorswillselltheirsharestobuyerswiththehighestbiddingpriceonthetermsandconditionssatisfactorytotheInvestors.Toavoiddoubt,eachoftheInvestorshastherighttotransfer,sellordisposeofallorpartsofitsequityintheCompanyatitssolediscretionatanytime.若发生如下任一情形,则每一位投资人有权利按其持股比例要求实际控制人以回购价回购投资人持有的部分或全部公司股权:i.公司未能实现年或年的业绩承诺;ii.公司未能在前未能实现合格的首次公开发行;iii.公司现有股东出现重大个人诚信问题,尤其是公司出现投资人不知情的账外现金销售收支时。回购价等于该投资人支付的投资额加上每年%的内部收益回报率(包括公司已经向该投资人支付的现金分红)。即,如投资人要求实际控制人于第n年届满后回购其股权,则除上文中提到的回购权外,投资人亦有权向任何有兴趣的买方(公司的竞争对手除外)出让股权,包括任何战略投资者;在不止一个有兴趣的买方的情况下,这些股份将按照令投资人满意的条款和条件出售给出价最高的买方。为避免疑问,每一投资人均有权依照其独立判断转让、出售或处置其持有的全部或部分公司股权。LiquidationPreference优先清算权Intheeventofthe“DeemedLiquidation”,eachInvestorshallbepaid,priorandinpreferencetoanyshareholdersoftheCompanyotherthanInvestors,anamountequaltothePurchasePrice(the“Investors’Preference”).AfterpaymentoftheInvestor’sPreferenceinfull,allamounts,ifany,availablefordistributionshallbedistributedproratatotheallexistingshareholdersoftheCompany.DeemedLiquidationincludes(i)liquidation,dissolution,bankruptcyorwindingupoftheCompany,(ii)consolidation,mergerortransferoftheCompany’sequityasaresultofwhichthereisachangeofcontrol,(iii)sale,transferorotherdispositionofall,orsubstantiallyall,assetsoftheCompany,and(iv)exclusivetransferofall,orsubstantiallyall,intellectualpropertyoftheCompany.在“视为清算”发生时,投资人有权先于公司的其他股东获得相当于投资额的金额(简称“投资人的优先权”)。在全额支付投资人的优先权后,如果还有剩余,则剩余应按比例分配给公司的全体股东。“视为清算”包括(i)公司清算、解散、破产或结业,(ii)导致公司控制权发生变化的整合、合并或公司股权转让,(iii)出售、转让或以其它方式处置公司全部或几乎全部的资产(iv)排他性的转让公司全部或几乎全部的知识产权。ProtectiveProvisions保护性条款TheCompanyshallbeprohibitedfromtakinganyofthefollowingactionsunlesspreviouslyapprovedbyitsBoardofDirectorswiththeconsentofthedirectorappointedbytheInvestor:1.ModificationtothearticlesofassociationoftheCompany;2.Dissolution,liquidation,acquisition,mergerandrestructuringoftheCompany;3.Changeofbusinessline,expansionintonon-corebusinessesandoutboundoverseasinvestment;4.Transferofall,orsubstantiallyor,assetsoftheCompany;5.Sale,transfer,license(otherthananon-exclusivelicensegrantedintheordinarycourseofbusinessconsistentwithpastpractice)orotherdispositionofintellectualpropertyoftheCompany;6.Establishmentofjointventures,partnershipsorsubsidiaries;7.IPOaffairs,includingchoiceoftiming,venue,priceandunderwriter;8.Anysecurityoffering,includingequityanddebtsecurities,butexcludingbankloans;9.InvestmentsoverRMB;10.Borrowingsfromanythirdpartybeyondannualplanning,guaranteeorcollateralforanythirdparty,andanyactionoutsideoftheordinarycourseofbusinessthatmaycausematerialcontingentliability;11.DividendoftheCompany;12.ManagementincentiveplanunderwhichpartoftheequityoftheCompanywillbegrantedtothemanagementbyissuingnewshares;13.Changeofauditor,auditpolicyoftheCompanyoritsparentcompany.未经董事会和投资人任命的董事同意,公司不得采取下列任何一项行动:(i)公司章程的修改;(ii)公司的解散、清算、收购、兼并及重组;(iii)公司经营业务范围的改变,在非主营业务领域的扩张或任何境外投资;(iv)公司出售全部或几乎全部资产;(v)对公司知识产权进行出售、转让、许可或其它处置;(vi)成立任何合资企业、合伙制企业、子公司;(vii)公司上市,包括时间、价格、地点和承销商的选择;(viii)任何证券的发行(包括但不限于股权和债权类证券),不包括银行贷款;(ix)境内超过元人民币的投资;(x)在年度计划外向第三方申请或进行借贷,任何为第三方提供保证或资产担保,以及其它可能产生或有负债的行为;(xi)公司的分红决定;(xii)通过增发新股来实施的管理层及员工的股权激励方案;(xiii)负责公司审计的会计师事务所的变动、公司审计政策的变动。ESOP员工股权激励计划TheCompanywillcarryoutESOPaftertheclosing,inthemannerthattheActualControllertransfershis/hersharestorelatedemployees.ESOPmaybecarriedoutinanyothermannerwiththeInvestors’priorconsent.公司将在本轮投资完成后实施员工股权激励计划,该计划将以实际控制人向公司员工转让股权的方式进行实施。经投资人事先书面同意,公司可采用其它的方式实施员工股权激励计划BoardofDirectors董事会TheBoardofDirectorswillbeconsistedofdirectors.TheInvestorshallhavetherighttoappointDirector.公司董事会将由名董事组成。其中,投资人有权任命名董事会成员。Non-competition竞业禁止TheCompanyshallenterintoNon-CompetitionAgreementwithmajormanagementpersonnelandkeytechnicalstaffunderwhich,noneofthemmay,duringhisemploymentperiodwiththeCompany,workforothercompaniespart-timeorengageinorassistotherpersoninanybusinessthatiscompetitivetotheCompany’sbusinesses,ormay,withintwoyearsafterterminationofhisemploymentwiththeCompany,workforanycompanieswhosebusinessesarerelatedtotheCompany’sbusinesses.Withoutpriorwrittenconsent,noneoftheexistingshareholdersoftheCompany,maydirectlyorindirectlyestablishorparticipateinestablishinganyentitywhosebusinessisidentical,relatedorcompetitivetotheCompany’sbusiness公司应与公司主要管理人员、核心技术人员签订《竞业禁止协议》,在任职期间内不得在其他企业兼职,不得从事或帮助他人从事与公司形成竞争关系的任何其它业务经营活动,在离开公司2年内不得在与公司经营业务相关的企业任职;未经投资人书面同意,公司原股东不得直接或间接设立或参与设立新的与公司业务相同、相关联、相竞争的其他经营实体。EmploymentContracts员工合同TheCompanyshalltryitsbesteffortstoensureeachoftheKeyEmployeesoftheCompanyenterintoanemploymentcontractofnonlessthanthreeyearsthatincludesnon-competition,non-disclosure,inventionownershipclausesacceptabletotheInvestor.公司应尽力促使公司的每一位关键员工和公司签订至少三年的劳动合同,并且该合同中的竞业禁止、保密以及发明归属条款必须为投资人所接受。Expenses费用AllcostsandexpensesreasonablyincurredtotheInvestorrelatingto(1)financialduediligencebythirdpartyconsultant,(2)legalduediligencebythirdpartyattorneys,and(3)draftingandreviewingDefinitiveAgreementsbyexternallawyers(collectivelyreferredtoas“Expenses”),shallbebornebytheCompanyiftheLoanisconsummated.SuchExpensesarecappedatRMB(orRMBiftheDefinitiveAgreementsneedtobedraftedinbilingualversions)andanyexceessoverthecapwillbebornbytheInvestor.Ifthistransactionisnotconsummatedduetoanyofthefollowingreasons,theCompanyshallbeartheExpenseswithintheabovecap:(1)theCompanydecidesnottopursuethistransaction;or(2)theInvestordecidestogiveupthetransactionduetoinaccurateormisleadinginformationthattheCompanyoritsActualControllerhasprovidedtotheInvestorormateriallegalobstaclefoundduringtheduediligenceprocessthatwillstoptheCompanyfromQualifiedIPO.Ifthistransactionfailedforreasonsotherthanthoselistedabove,theInvestorshallbeartheExpenses.如果投资顺利完成,公司应承担投资者需支出的全部合理费用和花费,这些花费和费用包括:(1)第三方财务尽职调查的费用,(2)第三方法律尽职调查的费用,及(3)外部律师起草及审核最终协议的费用(以下统称“费用”),但总额不超过人民币万元(或者人民币万,如果最终协议需要双语版本),超额部分由投资人承担。如本交易由于下列任何一项原因没有完成,则公司应在上述总额范围内承担所有费用:(1)公司决定放弃本交易,或(2)由于公司和实际控制人提供的信息不真实或具有误导性或者在尽职调查中发现阻碍公司上市的实质性法律障碍而导致投资者放弃此交易。如果非上述原因造成本交易失败,投资者应承担费用。No-shop排他性TheCompanyagreesthatforaperiodofdaysfollowingtheexecutionofthisTermSheetprovidedthatsuchperiodmaybeextendedforanadditional30dayswiththemutualconsentoftheCompanyandtheInvestor(the“NoShopPeriod”),neithertheHoldingCompany,theActualController,ortheCompanynoranyagentthereof,directlyorindirectly,willsolicit,consider,negotiateorotherwisediscussapossiblemerger,saleorotherdispositionofamaterialassetoftheCompany,oraninvestmentinitscapitalstockwith,ortransferanyequityoftheCompanytoanyotherparty,withoutthepriorwrittenconsentoftheInvestor.在本投资条款清单签署后的天内(在公司和投资人均同意的情况下,可以延长天(简称“排他期间”)),控股公司、实际控制人、公司或其代理均不得在未获得投资人的书面同意前直接或间接地邀请、考虑或以其它方式谈论可能的合并、出售或以其它方式处置公司的重要资产或公司进行股权融资,也不得出售公司的任何股权。DefinitiveAgreement最终协议AsaconditiontoClosingofthetransaction,thepartiesshallnegotiateandenterintomutuallyacceptabledetaileddefinitiveagreements(the“DefinitiveAgreements”)incorporatingthetermsofthisTermSheetandothertermsandconditionsincluding,withoutlimitation,representationsandwarranties,conditionstoclosingandindemnitiesandothertermsandconditionswhichareprevalentintransactionsofthisnatureorasmaybeagreedbytheparties.作为本交易交割的条件,各方应协商讨论互相可接受的最终详尽协议(简称“最终协议”),最终协议应合并本投资条款清单中所列条款和其它条款及条件,包括但不限于:声明与保证,交割条件和赔偿,以及其它此类股权投资交易中的普遍条款和条件,或被双方认可的条款和条件。Confidential保密Exceptasrequiredunderanyapplicablelaworstockexchangerules,thepartiesshallnotdiscloseorrevealtoanypersonanyinformationrelatingtothetermsandconditions(andexistence)ofthisTermSheet,theInvestor’proposedtransaction,orthenegotiationsbetweentheparties.Thepartiesareawarethatanyunauthorizeddisclosureoftheaboveinformationmayhaveanadverseeffectontheproposedtransaction.有关投资的条款和细则(包括此条款清单说明、投资人的投资建议以及双方谈判记录)均属保密信息,各方不得向任何第三方透露,除非任何现行法律或证券交易所另有规定。各方应意识到,任何未经授权的信息透露都可能会给交易带来负面影响。GoverningLaw适用法律ThelawsofChinashallgovernthisTermSheetandwillgoverntheDefinitiveAgreements.AnydisputearisinginrelationtothisTermSheetortheDefinitiveAgreementsshallbesubmittedtotheSIACforarbitrationforaward.本条款及最终协议适用于中华人民共和国法律。任何由本条款,或与本股权投资相关的法律文件引起的争议或索赔将由上海国际仲裁中心仲裁。Language语言ThisTermSheetiswritteninbothChineseandEnglish.Incaseofanyconflicts,theChineseversionshallprevail.本投资条款以中文和英文拟就,中文和英文表述不一致的情况下,以中文表述为准。SignaturePagestoFollow签字页附后SignaturePage/签字页英飞尼迪创业投资中心(有限合伙)By:Title:Date:By:Title:Date:ActualController:实际控制人:By:PrintName:Mr.IDNumber(身份证号码):Date:',)

提供股权投资条款清单,股权投资尽职调查清单会员下载,编号:1700806518,格式为 docx,文件大小为13页,请使用软件:wps,office word 进行编辑,PPT模板中文字,图片,动画效果均可修改,PPT模板下载后图片无水印,更多精品PPT素材下载尽在某某PPT网。所有作品均是用户自行上传分享并拥有版权或使用权,仅供网友学习交流,未经上传用户书面授权,请勿作他用。若您的权利被侵害,请联系963098962@qq.com进行删除处理。

下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载