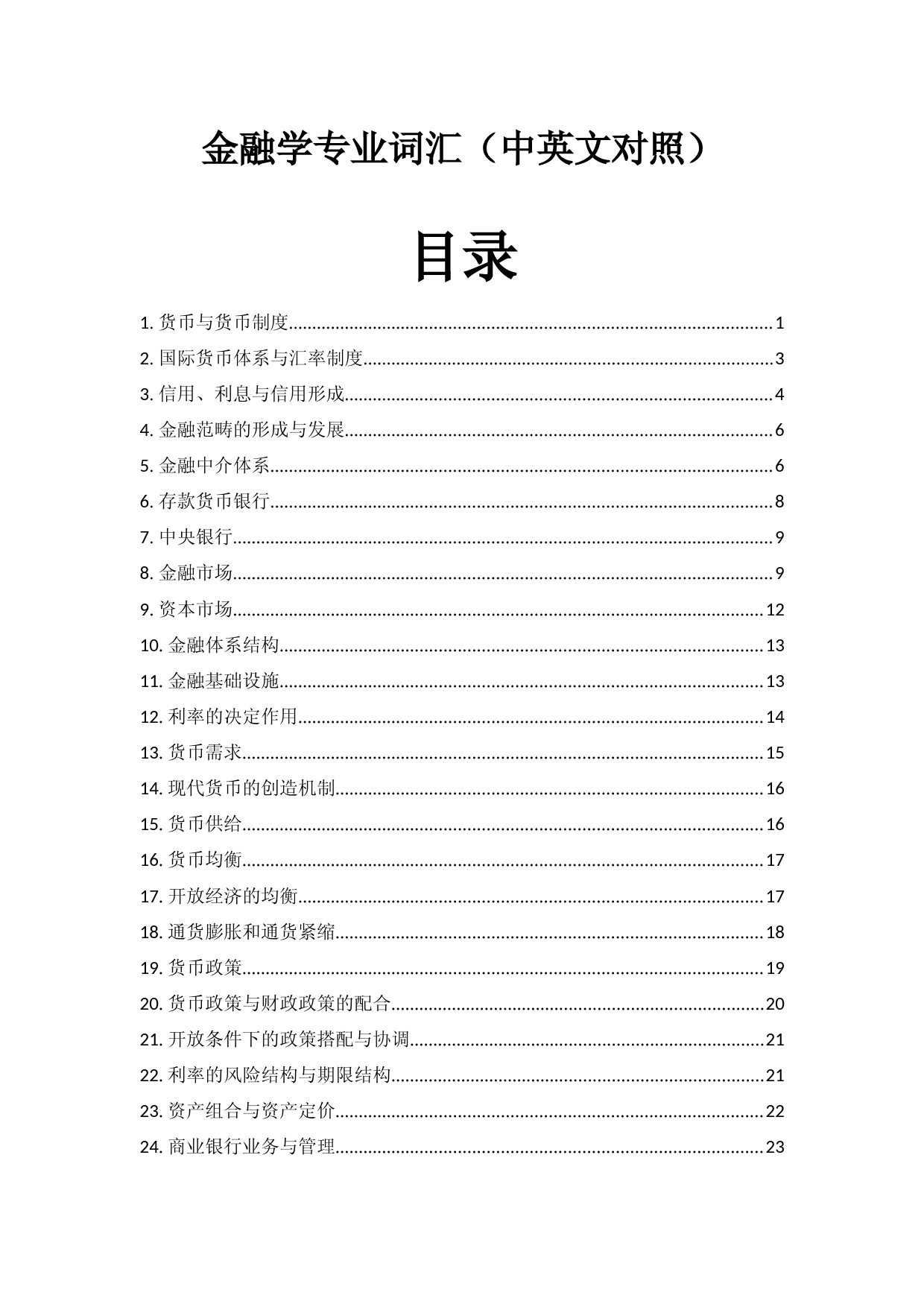

金融学专业词汇(中英文对照)

本作品内容为金融学专业词汇(中英文对照),格式为 docx ,大小 37980 KB ,页数为 28页

('金融学专业词汇(中英文对照)目录1.货币与货币制度......................................................................................................12.国际货币体系与汇率制度.......................................................................................33.信用、利息与信用形成..........................................................................................44.金融范畴的形成与发展..........................................................................................65.金融中介体系..........................................................................................................66.存款货币银行..........................................................................................................87.中央银行..................................................................................................................98.金融市场..................................................................................................................99.资本市场................................................................................................................1210.金融体系结构......................................................................................................1311.金融基础设施......................................................................................................1312.利率的决定作用..................................................................................................1413.货币需求..............................................................................................................1514.现代货币的创造机制..........................................................................................1615.货币供给..............................................................................................................1616.货币均衡..............................................................................................................1717.开放经济的均衡..................................................................................................1718.通货膨胀和通货紧缩..........................................................................................1819.货币政策..............................................................................................................1920.货币政策与财政政策的配合...............................................................................2021.开放条件下的政策搭配与协调...........................................................................2122.利率的风险结构与期限结构...............................................................................2123.资产组合与资产定价..........................................................................................2224.商业银行业务与管理..........................................................................................2325.货币经济与实际经济..........................................................................................2526.金融发展与经济增长..........................................................................................2527.金融脆弱性与金融危机......................................................................................2628.金融监管..............................................................................................................261.货币与货币制度货币:(currency)外汇:(foreignexchange)铸币:(coin)银行券:(banknote)纸币:(papercurrency)存款货币:(depositmoney)价值尺度:(measureofvalues)货币单位:(currencyunit)货币购买力:(purchasingpowerofmoney)购买力平价:(purchasingpowerparity,PPP)流通手段:(meansofcirculation)购买手段:(meansofpurchasing)交易的媒介:(mediaofexchange)支付手段:(meansofpayment)货币需求:(demandformoney)货币流通速度:(velocityofmoney)保存价值:(storeofvalue)汇率:(exchangerate)一般等价物:(universalequivalent)流动性:(liquidity)通货:(currency)准货币:(quasimoney)货币制度:(monetarysystem)本位制:(standard)金本位:(goldstandard)造币:(coinage)铸币税:(seigniorage)本位币:(standardmoney)辅币:(fractionalmoney)货币法偿能力:(legaltenderpowers)复本位制:(bimetallicstandard)金汇兑本位:(goldexchangestandard)金平价:(goldparity)金块本位制:(goldbullionstandard)2.国际货币体系与汇率制度浮动汇率制:(floatingexchangerateregime)货币局制度:(currencyboardarrangement)联系汇率制度:(linkedexchangeratesystem)美元化:(dollarization)最优通货区理论:(theoryofoptimumcurrencyarea)货币消亡:(moneydisappearance)外汇:(foreigncurrency)外汇管理:(exchangeregulation)外汇管制:(exchangecontrol)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(currentaccount)资本项目:(capitalaccount)汇率:(exchangerate)牌价:(postedprice)直接标价法:(directquotation)间接标价法:(indirectquotation)单一汇率:(unitaryexchangerate)多重汇率:(multipleexchangerate)市场汇率:(marketexchangerate)官方汇率:(officialexchangerate)黑市:(blackmarket)固定汇率:(fixedexchangerate)浮动汇率:(floatingexchangerate)管理浮动:(managedfloat)盯住汇率制度:(peggedexchangerateregime)固定钉住:(fixedpeg)在水平带内的盯住:(peggedwithinhorizontalbands)爬行钉住:(crawlingpeg)外汇指定银行:(designatedforeignexchangebank)货币的对外价值:(externalvalueofexchange)货币的对内价值:(internalvalueofexchange)名义汇率:(nominalexchangerate)实际汇率:(realexchangerate)铸币平价:(mintparity)金平价:(goldparity)黄金输送点:(goldtransportpoint)国际借贷说:(theoryofinternationalindebtedness)流动债权:(currentclaim)流动负债:(currentliablity)国际收支说:(theoryofbalancepayment)汇兑心理说:(psychologytheoryofexchangerate)货币分析说:(monetaryapproach)金融资产说:(portfoliotheoryofexchangeratedetermination)利率平价理论:(theoryofinterestrateparity)外汇风险:(exchangerisk)中国的外汇调剂:(foreignexchangeswap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalizationofinterest)高利贷:(usury)利率:(interestrate)债权:(claim)债务:(debtobligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporalbudgetconstraint)资金流量:(flowoffunds)部门:(sector)借贷资本:(loancapital)实体:(real)商业信用:(commercialcredit)银行信用:(bankcredit)本票:(promissorynote)汇票:(billofexchange)商业本票:(commercialpaper)商业汇票:(commercialbill)承兑:(acceptance)背书:(endorsement)直接融资:(directfinance)间接融资:(indirectfinance)短期国库卷:(treasurybill)中期国库卷:(treasurynote)长期国库卷:(treasurybond)国债:(nationaldebt)公债:(publicdebt)资本输出:(exportofcapital)国际资本流动:(internationalcapitalflow)国外商业性借贷:(foreigndirectinvestment,FDI)国际游资:(hotmoney)4.金融范畴的形成与发展财政:(publicfinance)公司理财:(corporatefinance)投资:(investment)保险:(insurance)财产保险:(propertyinsurance)人身保险:(mutuallifeinsurance)相互人寿保险:(mutuallifeinsurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financialintermediary)金融机构:(financialinstitution)借者:(borrower)贷者:(lender)货币中介:(monetaryintermediation)权益资本:(equitycapital)中央银行:(centralbank)货币当局:(monetaryauthority)存款货币银行:(depositmoneybank)商业银行:(commercialbank)投资银行:(investmentbank)商人银行:(merchantbank)财务公司:(financialcompanies)储蓄银行:(savingbank)抵押银行:(mortgagebank)信用合作社:(creditcooperative)保险业:(insuranceindustry)跨国银行:(multinationalbank)代表处:(representativeoffice)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortiumbank)中国人民银行:(People’sBankofChina)政策性银行:(policybanks)国有商业银行:(state-ownedcommercialbanks)资产管理公司:(assetsmanagementcompany)证券公司:(securitiescompany)券商:(securitiesdealer)农村信用合作社:(ruralcreditcooperatives)城市信用合作社:(urbancreditcooperatives)信托投资公司:(trustandinvestmentcompanies)信托:(trust)金融租赁:(financialleasing)邮政储蓄:(postalsavings)财产保险:(propertyinsurance)商业保险:(commercialinsurance)社会保险:(socialinsurance)保险深度:(insuranceintensity)保险密度:(insurancedensity)投资基金:(investmentfunds)证券投资基金:(securityfunds)封闭式基金:(closed-endinvestmentfunds)开放式基金:(open-endinvestmentfunds)私募基金:(privateplacement)风险投资基金:(venturefunds)特别提款权:(specialdrawingright,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(moneydealer)银行业:(banking)贴现率:(discountrate)职能分工型商业银行:(functionaldivisioncommercialbank)全能型商业银行:(multi-functioncommercialbank)综合性商业银行:(comprehensivecommercialbank)单元银行制度:(unitbankingsystem)总分行制度:(branchbankingsystem)代理行制度:(correspondentbankingsystem)银行控股公司制度:(shareholdingbankingsystem)连锁银行制度:(chainsbankingsystem)金融创新:(financialinnovation)自动转账制度:(automatictransferservices,ATS)可转让支付命令账户:(negotiableorderofwithdrawalaccount,NOW)货币市场互助基金:(moneymarketmutualfund,MMMF)货币市场存款账户:(moneymarketdepositaccount,MMDA)不良债权:(badclaim)坏账:(badloan)不良贷款:(non-performingloans,NPL)存款保险制度:(depositinsurancesystem)金融资本:(financialcapital)7.中央银行中央银行:(centralbank)一元式中央银行制度:(unitcentralbanksystem)二元式中央银行制度:(dualcentralbanksystem)复合中央银行制度:(compoundcentralbanksystem)跨国中央银行制度:(multinationalcentralbanksystem)发行的银行:(bankofissue)银行的银行:(bankofbank)最后贷款人:(lenderoflastresort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(thestatebank)8.金融市场金融市场:(financialmarket)证券化:(securitization)金融资产:(financialassets)金融工具:(financialinstruments)金融产品:(financialproducts)衍生金融产品:(derivativefinancialproducts)原生金融产品:(underlyingfinancialproducts)流动性:(liquidity)变现:(encashment)买卖差价:(bid-askspread)做市商:(marketmarker)到期日:(duedate)信用风险:(creditrisk)市场风险:(marketrisk)名义收益率:(nominalyield)现时收益率:(currentyield)平均收益率:(averageyield)内在价值:(intrinsicvalue)直接融资:(directfinance)间接融资:(indirectfinance)货币市场:(moneymarket)资本市场:(capitalmarket)现货市场:(spotmarket)期货市场:(futuresmarket)机构投资人:(institutionalinvestor)资信度:(creditstanding)融通票据:(financialpaper)银行承兑票据:(bankacceptance)贴现:(discount)大额存单:(certificatesofdesposit,CDs)回购:(counterpurchase)回购协议:(repurchaseagreement)隔夜:(overnight)银行同业间拆借市场:(interbankmarket)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(calloption)看跌期权:(putoption)期权费:(optionpremium)互换:(swap)投资基金:(investmentfunds)契约型基金:(contractualtypeinvestmentfund)单位型基金:(unitfunds)基金型基金:(fundingfunds)公司型基金:(corporatetypeinvestmentfund)投资管理公司:(investmentmanagementcompany)共同基金:(mutualfund)对冲基金:(hedgefund)风投基金:(venturefund)权益投资:(equityinvestment)收益基金:(incomefunds)增长基金:(growthfunds)长期增长基金:(long-termgrowthfunds)高增长基金:(go-gogroethfunds)货币市场基金:(moneymarketfunds)养老基金:(pensionfund)外汇市场:(foreignexchangemarket)风险资本:(venturecapital)权益资本:(equitycapital)私人权益资本市场:(privateequitymarket)有限合伙制:(limitedpartnership)交易发起:(dealorigination)筛选投资机会:(screening)评价:(evaluation)交易设计:(dealstructure)投资后管理:(post-investmentactivities)创业板市场:(growthenterprisemarket,GEM)二板市场:(secondaryboardmarket)金融创新:(financialinnovation)金融自由化:(financialliberalization)全球化:(globalization)离岸金融市场:(off-shorefinancialcenter)9.资本市场权益:(equity)剩余索取权:(residualclaims)证券交易所:(stockexchange)交割:(delivery)过户:(transferownership)场外交易市场:(overthecounter,OTC)金融债券:(financialbond)抵押债券:(mortgagebond)担保信托债券:(collateraltrustbonds)信用债券:(trustbonds)次等信用债券:(subordinateddebenture)担保债券:(guaranteedbonds)初级市场:(primarymarket)二级市场:(secondarymarket)公募:(publicoffering)私募:(privateoffering)有价证券:(security)面值:(facevalue)市值:(marketvalue)股票价格指数:(sharepriceindex)有效市场假说:(effectivemarkethypothesis)弱有效市场:(weakefficientmarket)中度有效市场:(semi-efficientmarket)强有效市场:(strongefficientmarket)股份公司:(stockcertificate)股票:(stockcertificate)股东:(stockholder)所有权:(ownership)经营权:(rightofmanagement)10.金融体系结构功能主义金融观:(perspectiveoffinancialfunction)金融体系格局:(patternoffinancialsystem)激励:(incentive)公司治理:(corporategovernance)路径依赖:(pathdependency)市场主导型:(market-orientedtype)银行主导型:(banking-orientedtype)参与成本:(participativecost)影子银行体系:(theshadowbankingsystem)11.金融基础设施金融基础设施:(financialinfrastructures)支付清算系统:(paymentandclearingsystem)跨境支付系统:(cross-borderinter-bankpaymentsystem,CIPS)全额实时结算:(realtimegrosssystem)净额批量清算:(bulktransfernetsystem)大额资金转账系统:(wholesalefundstransfersystem)小额定时结算系统:(fixedtimeretailsystem)票据交换所:(clearinghouse)金融市场基础设施:(financialmarketinfrastructures)中央交易对手:(centralcounterparties,CCPs)双边清算体系:(bilateralclearingsystem)系统重要性支付体系核心原则:(thecoreprinciplesforsystemicallyimportantpaymentsystem)证券清算体系建议:(therecommendationsforcentralcounterparties)中央交易对手建议:(therecommendationsforcentralcounterparties)金融业标准:(financialstandards)盯市:(mark-to-market)公允价值:(fairvalue)金融部门评估规划:(financialsectorassessmentprogram)12.利率的决定作用可贷资金论:(loanablefundstheoryofinterest)储蓄的利率弹性:(interestelasticityofsaving)投资的利率弹性:(interestelasticityofinvestment)本金:(principal)回报率:(returns)基准利率:(benchmarkinterestrate)无风险利率:(risk-freeinterestrate)补偿:(compensation)风险溢价:(riskpremium)实际利率:(realinterestrate)名义利率:(nominalinterestrate)固定利率:(fixedinterestrate)浮动利率:(floatingrate)官定利率:(officialinterestrate)行业利率:(trade-regulatedrate)一般利率:(generalinterestrate)优惠利率:(preferentialinterestrate)贴息贷款:(loanofinterestsubsidy)年利率:(annualinterestrate)月利率:(monthlyinterestrate)日利率:(dailyinterestrate)拆息:(callmoneyinterest)13.货币需求货币需求:(demandformoney)货币数量论:(quantitytheoryofmoney)货币必要量:(volumeofmoneyneeded)货币流通速度:(velocityofmoney)交易方程式:(equationofexchange)剑桥方程式:(equationofCambridge)现金交易说:(cashtransactionapproach)现金余额说:(cashbalancetheory)货币需求动机:(motiveofthedemandformoney)交易动机:(transactionmotive)预防动机:(precautionarymotive)投机动机:(speculativemotive)流动性偏好:(liquiditypreference)流动性陷阱:(liquiditytrap)平方根法则:(square-rootrule)货币主义:(monetarism)恒久性收入:(permanentincome)机会成本变量:(opportunitycostvariable)名义货币需求:(nominaldemandformoney)实际货币需求:(realdemandformoney)客户保证金:(customer’ssecuritymarign)金融资产选择:(portfolioselection)14.现代货币的创造机制纯流通费用:(purecirculationcost)原始存款:(primarydeposit)派生存款:(derivativedeposit)派生乘数:(withdrawalmultiplier)现金损露:(lossofcashes)提现率:(withdrawalrate)创造乘数:(creationmultiplier)现金:(currency)基础货币:(basemoney)高能货币:(high-powermoney)货币乘数:(moneymultiplier)铸币收入:(seignioragerevenue)15.货币供给货币供给:(moneysupply)准货币:(quasimoney)名义货币供给:(nominalmoneysupply)实际货币供给:(realmoneysupply)股民保证金:(shareholder’ssecuritymargin)货币存量:(moneystock)公开市场操作:(open-marketoperation)贴现政策:(discountpolicy)再贴现率:(rediscountrate)法定准备金率:(legalreserveratio)财富效应:(wealtheffect)预期报酬率变动效应:(effectofexpectedyieldschange)现金持有量:(currencyholdings)超额准备金:(excessreserves)外生变量:(exogenousvariable)内生变量:(endogenousvariable)16.货币均衡均衡:(equilibrium)投资饥渴:(hugerforinvestment)软预算约束:(softbudgetconstraint)总需求:(aggregatedemand)总供给:(aggregatesupply)面纱论:(moneyveiltheory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balanceofpayments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statementforbalanceofpayments)经常项目:(currentaccount)资本和金融项目:(capitalandfinancialaccount)储备资产:(reserveassets)净误差与遗漏:(neterrorsandmissions)自主性交易:(autonomoustransaction)调节性交易:(accommodatingtransaction)偿债率:(debtserviceratio)顺差:(surplus)逆差:(deficit)最后清偿率:(lastliquidationratio)资本流动:(capitalmovements)项目融资:(projectfinance)外债:(externaldebt)资本外逃:(capitalflight)冲销性操作:(sterilizedoperation)非冲销性操作:(unsterilizedoperation)债务率:(debtratio)负债率:(liabilityratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation)恶性通货膨胀:(rampantinflation)爬行通货膨胀:(creepinginflation)温和通货膨胀:(moderateinflation)公开性通货膨胀:(openinflation)显性通货膨胀:(evidentinflation)隐蔽性通货膨胀:(hiddeninflation)输入型通货膨胀:(importofinflation)结构性通货膨胀:(structuralinflation)通货膨胀率:(inflationrate)居民消费物价指数:(CPI)零售物价指数:(RPI)批发物价指数:(WPI)冲减指数:(deflator)需求拉上型通货膨胀:(demand-pullinflation)成本推动型通货膨胀:(cost-pushinflation)工资-价格螺旋上升:(wage-pricespiral)强制储蓄:(forcedsaving)收入分配效应:(distributionaleffectofincome)财富分配效应:(distributionaleffectofwealth)滞胀:(stagflation)工资膨胀率:(wageinflation)紧缩性货币政策:(tightmonetarypolicy)紧缩银根:(tightmoney)紧缩信贷:(tightsqueeze)指数化:(indexation)通货紧缩:(deflation)19.货币政策货币政策:(monetarypolicy)金融政策:(financialpolicy)货币政策目标:(goalofmonetarypolicy)通货膨胀目标制:(inflationtargeting)逆风向原则:(principleofleaningagainstthewind)反周期货币政策:(countercyclemonetarypolicy)相机抉择:(discretionary)单一规则:(singlerule)告示效应:(bulletineffects)直接信用控制:(directcredit)信用配额:(creditallocation)流动性比率:(liquidityratio)间接信用控制:(indirectcreditcontrol)道义劝告:(moralsuasion)窗口指导:(windowguidence)信用贷款:(lending)传导机制:(conductionmechanism)中介指标:(intermediatetarget)信贷配给:(creditrationing)资产负债表渠道:(balancesheetchannel)时滞:(timelag)预期:(expectation)透明度:(transparency)信任:(credibility)软着陆:(softlanding)20.货币政策与财政政策的配合赤字:(deficit)经常性收入:(currentrevenue)税:(tax)费:(fee)经常性支出:(currentexpenditure)资本性收入:(capitalrevenue)补助:(grant)资本性支出:(capitalexpenditure)账面赤字:(bookdeficit)隐蔽赤字:(hiddendeficit)预算外:(off-budget)透支:(overdraft)净举债:(netfiancing)未清偿债券:(outstandingdebt)或有债务:(contingentliability)准备货币:(reservemoney)国债依存度:(publicdebtdependency)国债负担率:(publicdebt-to-GDPratio)国债偿债率:(governmentdebt-serviceratio)财政政策:(fiscalpolicy)补偿性财政货币政策:(compensatoryfiscalandmonetarypolicy)21.开放条件下的政策搭配与协调米德冲突:(Meade’sconflict)国际政策协调:(internationalpolicycoordination)信息交换:(informationexchange)危机管理:(crisismanagement)避免共享目标变量的冲突:(avoidingconflictsoversharedtargets)合作确定中介目标:(cooperationintermediatetargeting)部分协调:(fullcoordination)汇率目标区:(targetzoneofexchangerate)马歇尔-勒纳条件:(Marshall-Lernercondition)J曲线效应:(Jcurveeffect)22.利率的风险结构与期限结构单利:(simpleinterest)复利:(compoundinterest)现值:(presentvalue)终值:(futurevalue)竞价拍卖:(open-outcryauction)贴现值:(presentdiscountvalue)利率管制:(interestratecontrol)利率管理体制:(interestrateregulationsystem)存贷利差:(interestrateregulationsystem)利率风险结构:(riskstructureofinterestrates)违约风险:(defaultrisk)利率期限结构:(termstructureofinterestrates)即期利率:(spotrateofinterest)远期利率:(forwardrateofinterest)到期收益率:(yieldtomaturity)现金流:(cashfloe)预期理论:(expectationtheory)流动性理论:(liquiditytheory)偏好理论:(preferredhabitattheory)市场隔断理论:(marketsegmentationtheory)23.资产组合与资产定价市场风险:(marketrisk)信用风险:(creditrisk)流动性风险:(liquidityrisk)操作风险:(operationalrisk)法律风险:(legalrisk)政策风险:(policyrisk)道德风险:(moralhazard)主权风险:(sovereignrisk)市场流动性风险:(productliquidity)现金流风险:(cashflow)执行风险:(executionrisk)欺诈风险:(fraudrisk)遵守与监管风险:(complianceandregulatoryrisk)资产组合理论:(portfoliotheory)系统性风险:(systematicrisk)非系统性风险:(nonsystematicrisk)效益边界:(efficientfrontier)价值评估:(evaluation)市盈率:(price-earningratio)资产定价模型:(assetpricingmodel)资本资产定价模型:(capitalassetpricingmodel,CAPM)无风险资产:(risk-freeassets)市场组合:(marketportfolio)多要素模型:(multifactorCAPM)套利定价理论:(arbitragepricingtheory,APT)期权加价:(optionpremium)内在价值:(intrinsicvalue)时间价值:(timevalue)执行价格:(strikeprice)看涨期权:(calloption)看跌期权:(putoption)对冲型的资产组合:(hedgeportfolios)套利:(arbitrage)无套利均衡:(no-arbitrageequilibrium)均衡价格:(equilibriumprice)多头:(longposition)空头:(shortposition)动态复制:(dynamicreplication)头寸:(position)风险偏好:(riskpreference)风险中性:(riskneutral)风险厌恶:(riskaverse)风险中性定价:(risk-neturalpricing)24.商业银行业务与管理银行负责业务:(liabilitybusiness)存款:(deposit)活期存款:(demanddeposit)支票存款:(checkdeposit)透支:(overdraft)定期存款:(timedeposit)再贴现:(rediscount)金融债券:(financialbond)抵押贷款:(mortgageloan)信用贷款:(creditloan)通知贷款:(demandloan)真实票据论:(realbilldoctrine)商业贷款理论:(commercialloantheory)证券投资:(portfolioinvestment)中间业务:(middlemanbusiness)表外业务:(off-balancesheetbusiness)无风险业务:(risk-freebusiness)汇款:(remittance)信用证:(letterofcredit)商品信用证:(commercialletterofcredit)代收业务:(businessofcollection)代客买卖业务:(businessofcommission)承兑网络银行:(internetbank)虚拟银行:(virtualbank)企业对个人:(B2C)企业对企业:(B2B)挤兑:(bankruns)资产管理:(assetsmanagement)自偿性:(self-liquidation)可转换性理论:(convertibilitytheory)预期收入理论:(anticipatedincometheory)负债管理:(liabilitymanagement)资产负债综合管理:(comprehensivemanagementofassetsandliability)风险管理:(riskmanagement)在险价值:(valueatrisk,VAR)25.货币经济与实际经济两分法:(dichotomy)实际经济:(realeconomy)货币经济:(monetaryeconomy)虚拟资本:(monetarycapital)泡沫经济:(bubbleeconomy)虚拟经济:(virtualeconomy)货币中性:(neutralityofmoney)相对价格:(relativeprice)货币面纱:(monetaryveil)瓦尔拉斯均衡:(Walrasequilibrium)一般均衡理论:(theoryofgeneralequilibrium)超中性:(super-neutrality)26.金融发展与经济增长金融发展:(financialdevelopment)金融自由化:(financialliberalization)金融深化:(financialdeepening)金融压抑:(financialrepression)金融机构化:(financialinstitutionalization)分层比率:(gradationratio)金融相关率:(financialinterrelationratio,FIR)货币化率:(monetarizationratio)脱媒:(distintermediation)导管效应:(tubeeffect)27.金融脆弱性与金融危机金融脆弱性:(financialfragility)金融风险:(financialrisk)长周期:(longcycles)安全边界:(marginsofsafety)汇率超调理论:(theoryofexchangerateovershooting)金融危机:(financialcrises)资产管理公司:(assetmanagementcorporation,AMC)金融恐慌:(financialpanic)优先/次级抵押贷款债券:(senior/subordinatestructure)28.金融监管金融监管:(financialregulation)公共选择:(publicchoice)最低资本要求:(minimumcapitalrequirements)监管当局的监管:(supervisoryreviewprocess)市场纪律:(marketdiscipline)宏观审慎框架:(macro-prudentialframework)分行:(branch)子行:(subsidiary)并表监管:(consolidatedsupervision)',)

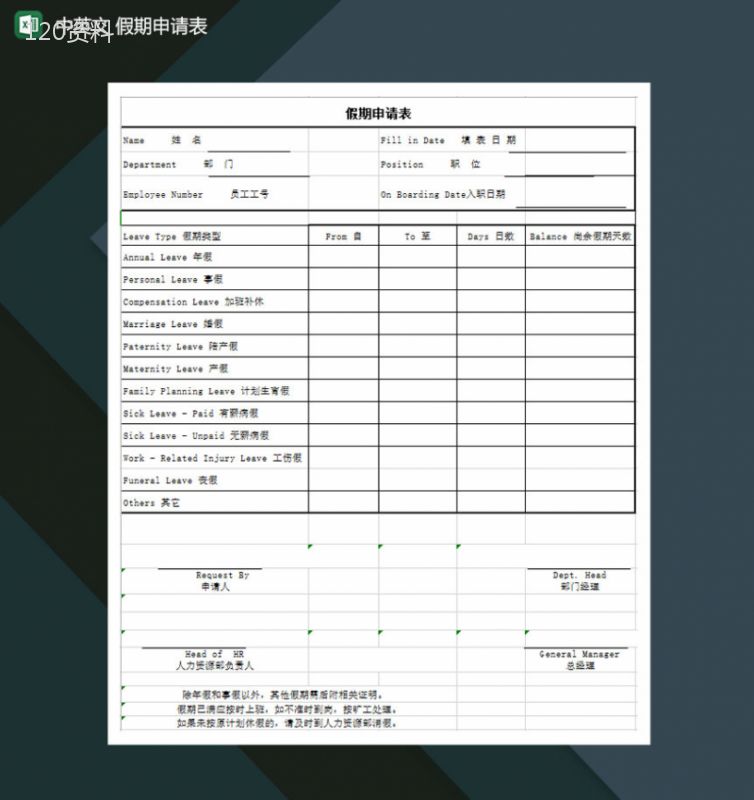

提供金融学专业词汇(中英文对照)会员下载,编号:1700789010,格式为 docx,文件大小为28页,请使用软件:wps,office word 进行编辑,PPT模板中文字,图片,动画效果均可修改,PPT模板下载后图片无水印,更多精品PPT素材下载尽在某某PPT网。所有作品均是用户自行上传分享并拥有版权或使用权,仅供网友学习交流,未经上传用户书面授权,请勿作他用。若您的权利被侵害,请联系963098962@qq.com进行删除处理。

下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载 下载

下载